Everything You Need to Know About Audit Automation

Audit automation doesn’t erase the human’s role in auditing – it arms people with technology they can use to produce better, more efficient results. Implementing audit automation leads to quality improvements, time savings, risk reduction, and risk intelligence.

What is audit automation?

The days of manually sifting through documents are behind us, all thanks to audit automation. Audit automation is a term describing the use of cloud computing and database software to automate auditing tasks like data entry and analysis. Automated workflows drastically reduce the time and effort required to carry out audit-related workflows.

Automation software designed for auditing helps organizations maintain compliance with greater accuracy and efficiency. The technology works by sifting through data, organizing it, and analyzing it to detect risk.

Digital audit vs audit automation

A digital audit (aka electronic audit) uses software to carry out the auditing process. Audit automation is often one part of the digital auditing process. It’s typically accompanied by software solutions for process documentation, data analysis, and communication.

Audit automation specifically refers to the process of automating certain steps in the auditing process to streamline workflows and limit human error.

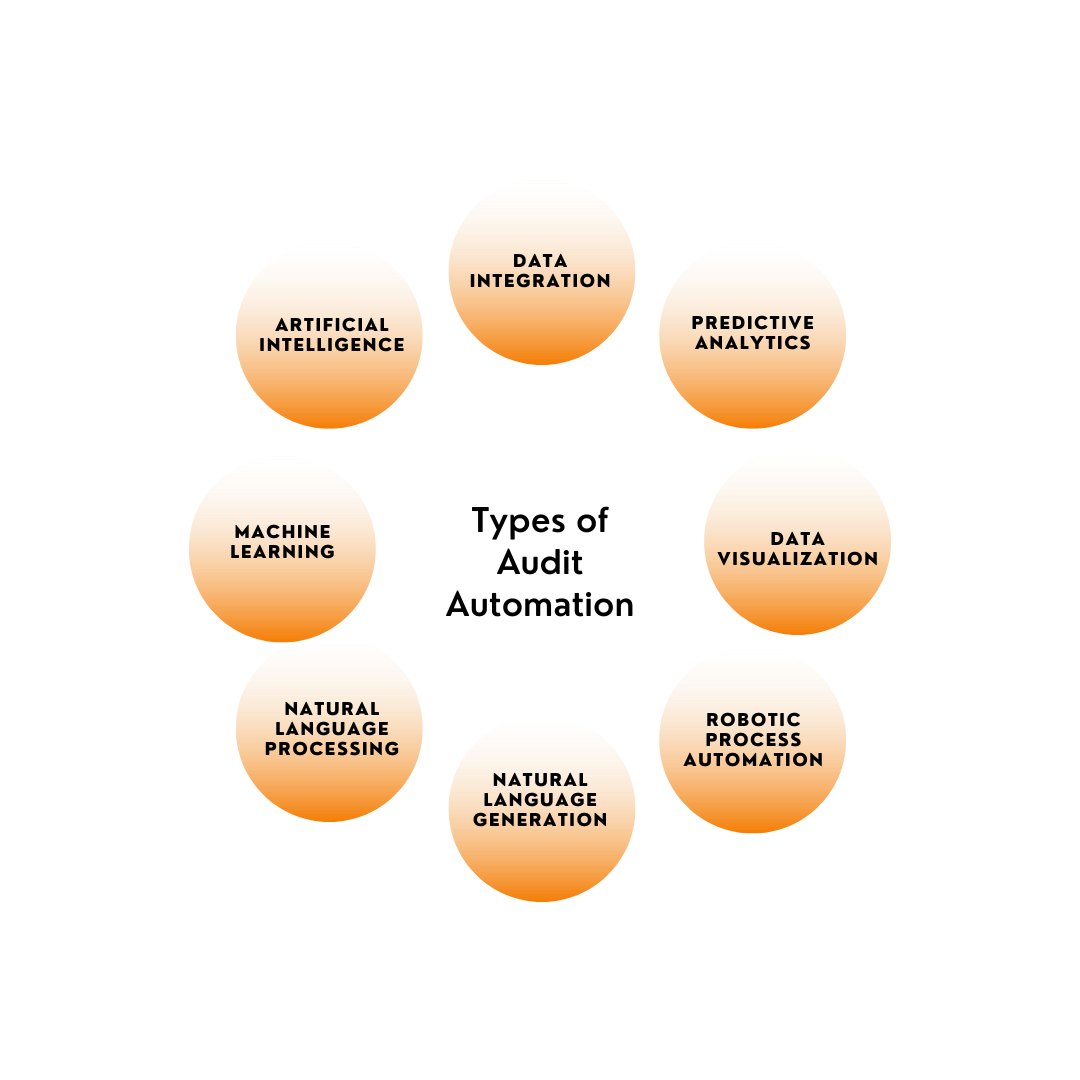

Types of audit automation

Within the world of audit automation lies a whole spectrum of technologies organizations use to improve efficiency and risk management. They range from predictive models and tools for data integration and visualization to advanced technologies with cognitive elements that mimic human behavior:

- Data integration: create a consistent information foundation.

- Predictive analytics: predicts risk with predictive models like compliance risk models.

- Data visualization: visually contextualizes data, like in a GRC dashboard.

- Robotic process automation: uses rules-based systems that mimic human behavior to automate parts of repeatable processes.

- Natural language generation: accept structured data inputs to generate unstructured narratives.

- Natural language processing: applications that process unstructured data and enable querying and generation of structured data.

- Machine learning: improves predictability and operations based on data received over time.

- Artificial intelligence: mimics human behavior like visual perception, speech recognition, division-making, and language translation.

Benefits of audit automation

Audit automation is revolutionizing the way audits are conducted across all industries. Using automation, auditors can reduce workloads, lower labor costs, and improve efficiency– ultimately producing more accurate data sets in a fraction of the time.

That speed is a huge asset considering regulations are shifting faster than ever. Swift auditing is essential for maintaining compliance in fast-paced industries. In addition to saving time, audit automation streamlines workflows and reduces the number of resources necessary to achieve compliance.

Let's dive a little deeper into each of those benefits.

Efficiency

The most obvious benefit for organizations automating their auditing processes is the drastic boost in efficiency. Much of the actual labor involved in carrying out an audit involves tedious, meticulous, mind-numbing tasks. With audit automation, hours spent on data entry and analysis can be replaced with the click of a button.

Businesses can automatically pull data from multiple sources, analyze, and get results in a fraction of the time they would normally spend on data from just one source. Bots are programmed to follow prescribed procedures, capture and maintain complete audit logs, and automate reporting.

Automation can even streamline collecting audit evidence by enabling users to upload documents and photos directly to the audit checklist.

Accuracy

Slow and steady might win the race if you’re running on human feet, but automation can’t relate. It’s easy to assume that greater speed will produce more errors. Audit automation isn’t affected by human error the way manual auditing is. Automating data collection and analysis reduces the risk of error and improves consistency, resulting in more accurate, reliable results.

Cost savings

Audit automation creates a ripple effect of efficiency and accuracy that reduces expenses and even increases profits across the entire organization. Automating manual tasks reduces the number of paid hours required to perform an audit. In addition to this drastic reduction in labor costs, automation bypasses costs associated with errors that go undetected.

Because automation gives organizations access to more audit data that is also standardized, consistent, and accurate, auditors can focus efforts on analysis and decision-making rather than grunt work like data collection and consolidation. This drives innovation and improves business processes, which translates to their bottom line.

Consistency

Automated auditing tasks are inherently consistent. They repeat the same predetermined processes and procedures to ensure audits are conducted the same way each time. These uniform processes are easily traceable, producing clear audit reports that simplify compliance. Mistakes are easily detected and addressed in a standardized system.

Automation software also ensures results are accurate and reliable. In conjunction with the standardized auditing process, automation software’s ability to create accurate and reliable audit results creates a bulletproof level of consistency.

Risk management

Audit automation identifies irregularities, malfunctions, and potential risks faster and more accurately than manual auditing. As a result, risks are identified sooner and can be mitigated before they become a problem.

Stakeholder communication

Audit-related information is easily shareable between stakeholders. This opens a secure channel for collaboration and communication, improving auditor/investor/client relationships in the process.

Audit automation use cases

Audit automation helps companies optimize scarce resources. Automating manual activities frees up employee capacity. Focus can then shift to higher-impact activities like process improvement. Greater investment in higher-value tasks accelerates and improves operating effectiveness.

Automation is especially beneficial for cases that require:

- A high degree of accuracy and consistency

- Repetitive, manual processing

- Pulling information from scattered sources

- Heavy data entry, data manipulation, and report generation

Here are some examples of how audit automation can seamlessly integrate into the various stages of the auditing process.

1. Risk assessment

The main goal of this phase is to establish the audit entity universe, assess its completeness, analyze the risk profile, identify audit needs, develop the audit plan, and conduct business monitoring.

Organizations can streamline the risk assessment workflow by using analytic techniques and dashboards, robotic process automation, and natural language processing.

These automation tools are used for:

- Compliance risk assessment

- Location risk assessment visualization

- Cross-business unit/region comparative and flux analysis

- Continuous business operations monitoring

- Risk assessment dashboard

Tracking the changes that result from automating processes is crucial to successful implementation. Risks must be re-evaluated as changes occur. Organizations must also track technology reliability within business processes over time. Future audits should pay special attention to:

- Information controls, especially those for access and bot credentialing, change related to maintaining bots, and business continuity planning

- Accuracy, security, and completeness of stored data

- Potential risk for data leakage and privacy threats

- Cybersecurity incident response

- Distinction of duties between bot IDs and end users

- RPA governance that monitors bot throughput, processing errors, and exception handling through human intervention

2. Audit planning

The audit planning phase involves communicating the intention to audit, conducting the introduction and scoping meeting, completing the audit planning memorandum (APM), developing process understanding, identifying inherent risks and key controls, completing a risk control matrix, and completing the audit announcement memo.

Analytics techniques and dashboards, robotic process automation, and natural language processing optimize this phase by:

- Automating documents with lots of text

- Profiling business operations

- Conducting exploratory analytics and “what-if” analysis

3. Design effectiveness assessment

Assessing design effectiveness involves detailed audit planning, developing a testing strategy, and reviewing and approving the design effectiveness assessment (DEA). Analytics techniques and dashboards combined with robotic process automation facilitate:

- Automaton of internal audit tasks

- Data modeling

- Batched reporting

4. Fieldwork

Fieldwork is where auditors hold opening meetings, create operational effectiveness testing (OET) work papers, execute testing in accordance with the OET strategy, evaluate the operating effectiveness of key controls, and draft issues.

This phase of the auditing process can utilize every single audit automation tool– analytics techniques and dashboards, robotic process automation, natural language processing, and even natural language generation. These technologies are used to streamline:

- Population testing

- Data aggregation and integration

- Intelligent detection of suspicious logs associated with IT systems

5. Reporting/closing phase

This is the phase that produces the audit report. It covers an overview of the audit findings, reviews any issues identified during the auditing process, and assesses the organization’s overall operational health. Auditors draft the report, outlining observations and recommendations, have it reviewed and approved, then issue the final report to the organization being audited. The auditors then perform the audit folder closure, which involves organizing and storing audit-related documents. This phase also includes a cost-budget analysis, an audit team debrief, and an updated risk assessment.

The reporting phase utilizes analytics techniques, robotic processing automation, and natural language generation to:

- Automatically generate text-based audit reports

- Enable data visualization and an audit storyboard

- Perform impact quantification

6. Issue tracking/ongoing monitoring

Last up, we have the issue tracking/ongoing monitoring phase. This stage of the process relies on the history of issues tracking to develop insights through trends analysis and key performance indicators (KPIs). It can also establish the continuous auditing model.

Issue tracking utilizes analytics techniques and dashboards, robotic process automation, and natural language processing for:

- Real-time anomaly reporting

- Enhanced dashboarding and reporting

- Thematic risk identification

- Computer-aided engineering (CAE) dashboard

- Issue tracking visualization

Jumpstart your audit automation with a free trial of Forms On Fire®

Audit automation challenges

There is a potential risk of improper initiation or alteration of information. This may go undetected when recorded, processed, and reported electronically. Coding errors may occur when developed, or intentional and unintentional changes occur after the technology is deployed.

Changing environments can degrade the computer code’s underlying technology, rendering it less responsive.

To address these risks, organizations need processes that continuously monitor and confirm that output meets expectations.

Improper implementation or automation of the wrong processes can result in financial losses. Bot-related errors also hurt the integrity of cybersecurity programs or compliance with data privacy regulations, which results in monetary and reputational repercussions.

Avoiding this requires careful assessment of how changes inform IT risk assessment and how pre-existing standards, processes, and structures should be adjusted accordingly. Businesses must perform their own risk assessments associated with automated processes, design internal controls, and produce appropriate audit evidence.

Recommended reading: Learn

the difference between an inspection, an audit, and an assessment.

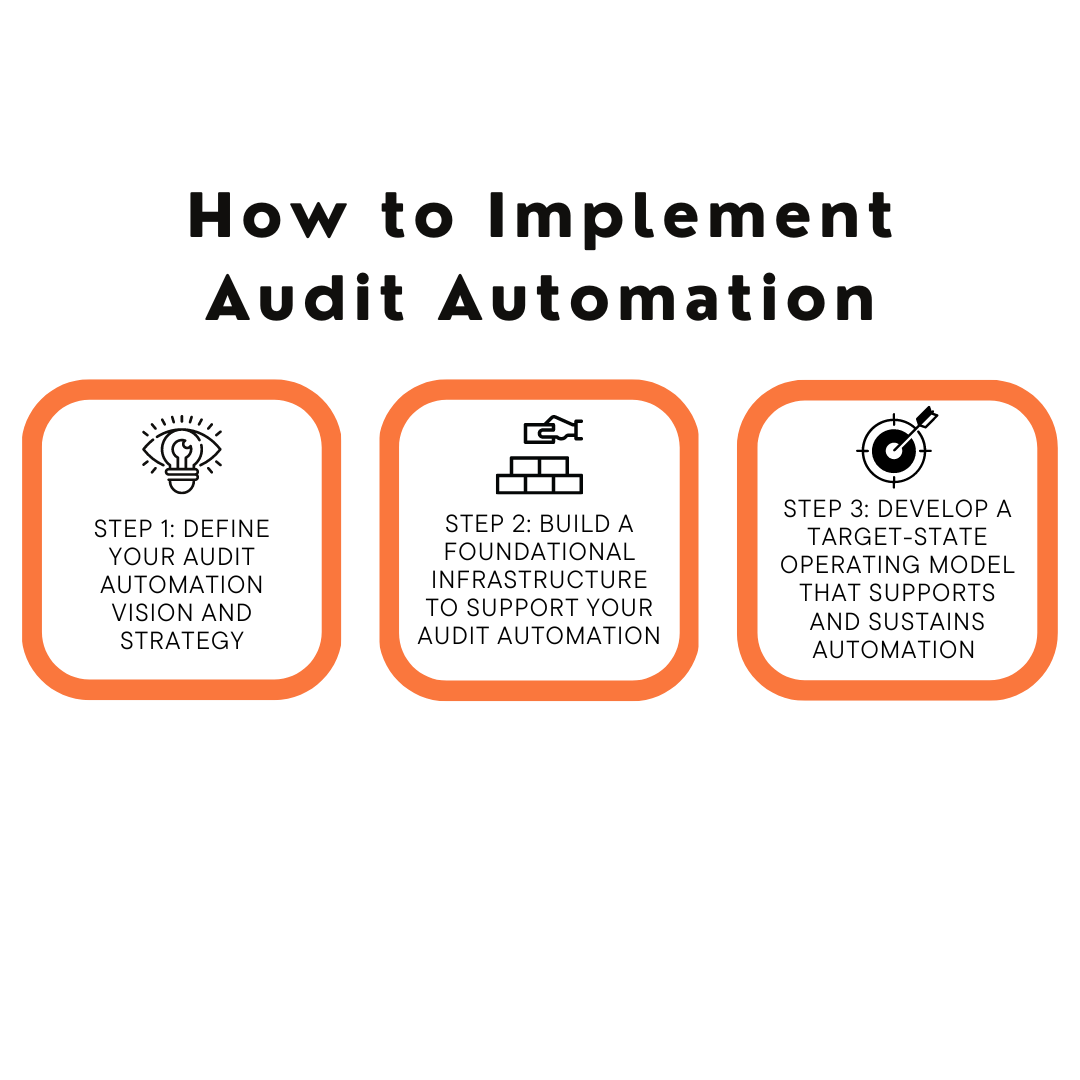

How to implement audit automation

Below are some important considerations to help audit automation work for your organization.

Step 1: Define your audit automation vision and strategy

Start by assessing where and how automation can be implemented into your auditing processes, as well as why each process should be automated.

Some organizations begin by automating test steps within a single audit, a data extraction process to supply standardized information for multiple other audits, or operational activities like hours tracking, reporting, certification management, etc.

Step 2: Build a foundational infrastructure to support your audit automation

Once the vision and strategy are clear, the next crucial step is to create a foundational infrastructure that facilitates implementation and future maintenance, while also mitigating risks. The governance model must weave accountability throughout the automation cycle, from creation all the way to monitoring its effectiveness. This involves the following:

- Enhanced governance: establishing the roles, responsibilities, and structures for identifying which tests and processes align with automation, as well as processes for handling designs, deployment, and documentation.

- Change management: create protocols for monitoring and addressing changes to the automation processes.

- Testing and monitoring: establish processes for quality assurance testing and monitoring.

- Exception handling and processing: outline a framework for triaging potential issues, and distinguishing/routing operational and technical expectations.

- Employee training: conduct capability assessments and training modules to supplement gaps in IT and data science knowledge.

Government agencies recommend RPA governance models address the following tasks:

- Name one executive sponsor who understands emerging automation technologies to spearhead implementation.

- Define RPA standards and policies

- Adapt existing internal controls to the automated environment

- Create access management policies and internal controls for bots to monitor the work of other bots

- Adapt bots to detect and report errors, signaling the need for human intervention when necessary

- Implement controls that manage bots through environment changes

- Create compliance policies and tools that track bot output

- Form cross-functional working groups and place certain individuals in charge of maintaining and managing bots

Step 3: Develop a target-state operating model that supports and sustains automation

Develop a target-state operating model as a natural extension of the current operating model, with adjustments to the interplay of people, processes, and software. This addresses how automation may reshape the current model, as well as how the target state supports the organization's overall automation goals. Use this step to identify opportunities for sharing service models between department functions.

Final thoughts

Audit automation improves audit efficiency and effectiveness, increases capacity, and produces more accurate, quality results. These are big changes, but they don’t affect operating models as much as you would expect.

Your target state operating model post-automation implementation remains the same– it simply tweaks the interplay of people, processes, and technology. At the end of the day, organizations can run audits without forcing employees to suffer through hours of mindless manual processes, redirecting intelligent human talent to high-impact activities.