How to Measure Regulatory Compliance

Regulatory compliance means following the laws, rules, and standards that govern your business. But that is easier said than done.

You're tracking requirements across multiple jurisdictions that contradict each other, documenting processes that span different departments and systems, and trying to capture real-time compliance activities with quarterly reports.

Most organizations discover they're not as compliant as they thought when regulators show up at their door.

Use this guide to set up the foundation for tracking compliance at your organization and establishing effective control systems.

Understanding regulatory compliance measurement

You can tick every compliance box perfectly, but if you can't prove it when regulators show up, it doesn’t matter.

Think of it this way — being compliant is like staying under the speed limit. Measuring compliance is having a working speedometer to prove you never exceeded 55 mph.

But not all compliance measurement works the same way. Internal compliance? You write the playbook. Set policies based on your risk tolerance and business needs. Track metrics like training completion rates and policy acknowledgments.

External compliance flips the script. Regulators write the rules, and you do what they tell you. Miss a filing deadline or botch documentation standards, and you're looking at fines (or worse). The measurement bar sits much higher here — everything needs audit-quality evidence.

Three groups inside a large organization typically juggle compliance measurement responsibilities:

- Compliance officers design the frameworks and interpret regulations. They know what needs measuring but don't control day-to-day operations.

- Department heads run the actual compliance activities. They understand their processes but often struggle with measurement requirements.

- Risk and audit teams verify that measurement systems work. They catch compliance gaps.

Defining what to measure in terms of compliance performance

You can't measure everything, and you shouldn't try. Smart compliance teams focus on three distinct types of requirements, each demanding different measurement approaches:

- Process-based requirements focus on how you do things. For example, employee background checks, loan approval workflows, or data encryption protocols. You're measuring whether specific steps happen in the correct order at the right time.

- Outcome-based requirements care about results, not methods. Emissions levels or customer complaint resolution times fall here. Regulators don't necessarily care how you achieve the target — just that you hit it.

- Documentation-based requirements demand proof of activities or decisions. Board meeting minutes, risk assessments, or incident reports fit this category. You're measuring completeness, accuracy, and timeliness of records.

| Requirement type | What you measure | Measurment approach | Common pitfalls |

|---|---|---|---|

| Process-based | Steps completed correctly | Track process adherence, sequence accuracy, and timing compliance | Measuring completion but ignoring quality |

| Outcome-based | Results achieved | Compare results against target KPIs, thresholds, or regulatory limits | Focusing only on pass/fail without trend analysis |

| Documentation-based | Records created and maintained | Audit records for accuracy, completeness, and timely submission | Measuring quantity over quality |

To make compliance easier to track, consider creating a compliance inventory. It sounds boring, but it's your roadmap to compliance tracking sanity.

Start by cataloging every law, regulation, and internal policy that applies to your organization. Don't just list titles — break down specific requirements and deadlines. Map each requirement to business processes and identify who owns compliance for that area.

Here's your action plan:

- Assign ownership for each regulatory domain to specific team members.

- Set up quarterly reviews to catch new requirements or regulation changes.

- Create a central repository that everyone can access and update.

- Link each requirement to your measurement framework.

The inventory becomes your single source of truth. When new regulations drop or existing ones change, you know exactly what measurements need updating. Teams stop duplicating efforts or missing requirements because everything lives in one place.

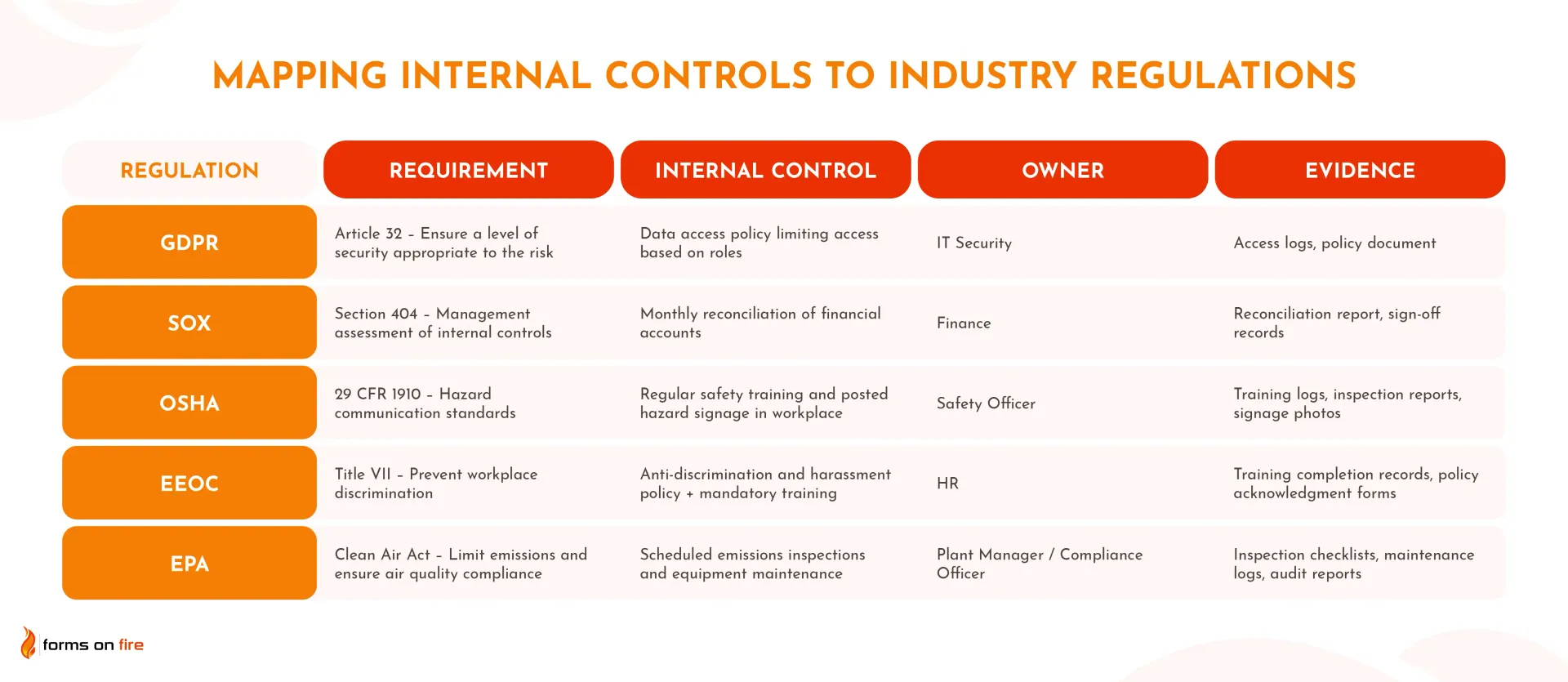

Mapping internal controls to regulatory requirements

Mapping is the process of aligning your internal processes, policies, and technical safeguards with the specific clauses, articles, or sections of applicable regulations.

It is used to demonstrate compliance to regulators and auditors, identify gaps or overlaps in controls, and simplify compliance tracking.

The process is time-consuming but straightforward:

- List applicable regulations: Identify which laws or standards apply to your business operations

- Break down requirements: Extract individual compliance clauses that are actionable or measurable.

- Identify corresponding controls: Link each requirement to one or more controls already in place. Note where new controls are needed.

- Assign ownership and evidence: Determine who owns the control and what proof exists (or should exist) to show it’s working.

When done, you should end up with this kind of table:

Many organizations use a compliance matrix in Excel or a GRC platform that allows them to manage mappings and keep everything up to date.

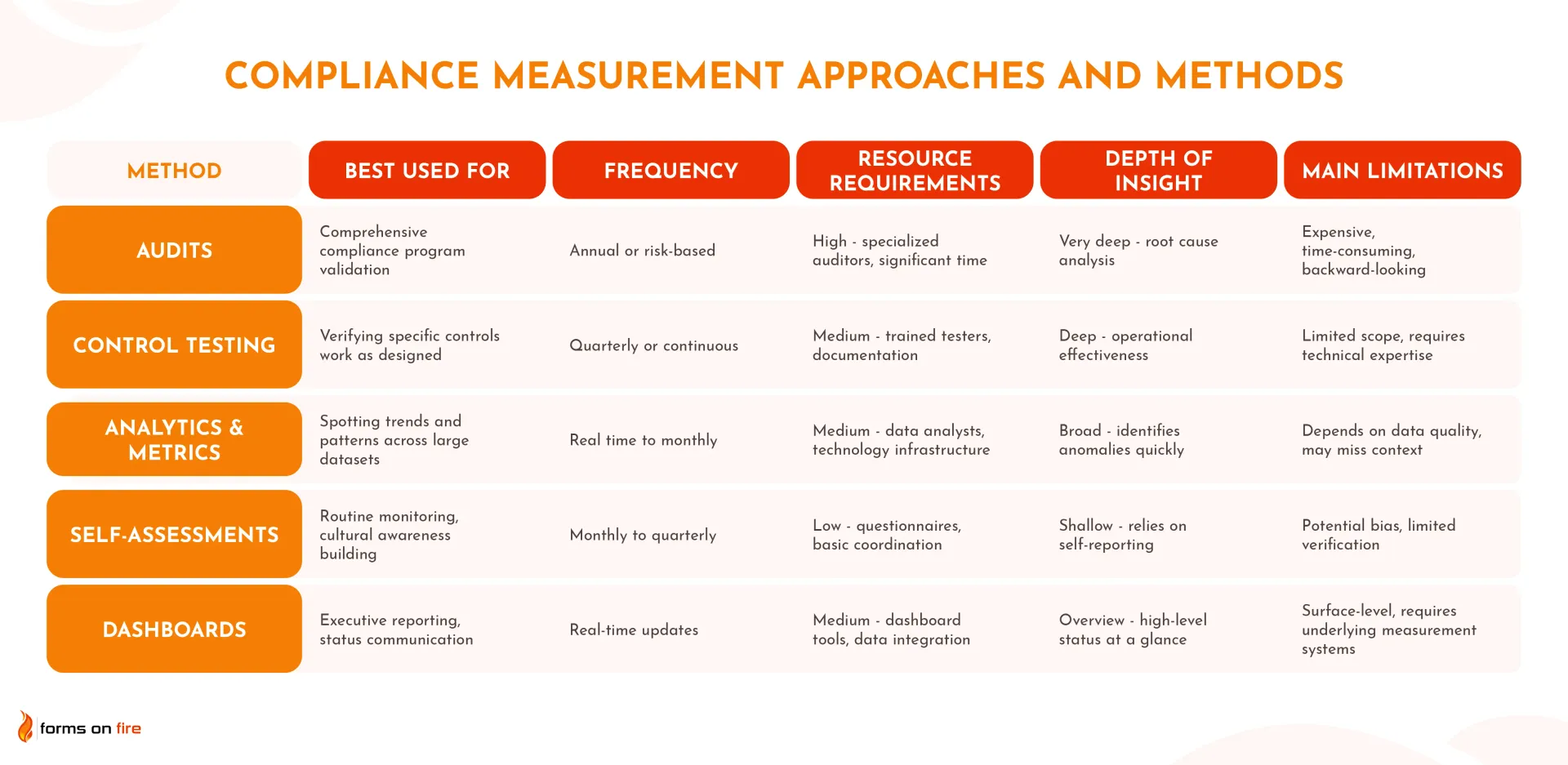

Compliance measurement approaches and methods

Different compliance challenges need different measurement tools. Here's your toolkit for building an effective monitoring system.

Audits

Internal audits provide deep-dive examinations of compliance programs to verify they work as designed. They catch gaps that surface-level monitoring misses and validate the effectiveness of your entire compliance framework.

How often you should conduct specific audits will depend on regulatory requirements. In general, the frequency should match the risk level — the higher the risk, the more often you perform the audit.

Control testing

Control testing verifies that your compliance controls actually prevent or detect violations. You're not just checking if controls exist — you're proving they work.

Use statistical sampling for high-volume processes, but test 100% of critical controls. Document everything meticulously since regulators often scrutinize control testing methodology as closely as the results.

For example, a manufacturing plant has specific safety lockout procedures in place to secure equipment before performing routine maintenance, cleaning, or repairs. Besides verifying that lockout policies exist, control testing might involve:

- Observing actual maintenance activities to confirm that workers follow the procedures.

- Checking that used lockout devices physically prevent equipment startup.

- Reviewing maintenance logs to ensure proper documentation.

If testing reveals that technicians skip certain lockout steps during urgent repairs, you've caught a control failure before it leads to a serious injury or OSHA violation.

Analytics and metrics

Data analytics spots patterns that manual reviews miss. You're looking for trends, anomalies, and early warning signs that suggest compliance problems brewing beneath the surface.

Common analytics applications include:

- Policy violation tracking across departments and time periods

- Access log analysis to identify unauthorized system usage

- Document retention compliance monitoring

- Training completion rates by employee group

- Incident response time analysis

Self-assessments

Self-assessments use questionnaires and internal reviews to gauge compliance health — like monthly safety checklists, environmental compliance surveys, or system access control self-audits. They're cost-effective and help embed compliance thinking into daily operations:

- Pros: Quick to deploy, covers broad ground, engages front-line staff in compliance thinking.

- Cons: Relies on self-reporting accuracy, potential for bias, limited depth of investigation.

Use self-assessments for routine monitoring and early problem identification, but always back them up with independent verification for critical areas through safety audits or other types of audits.

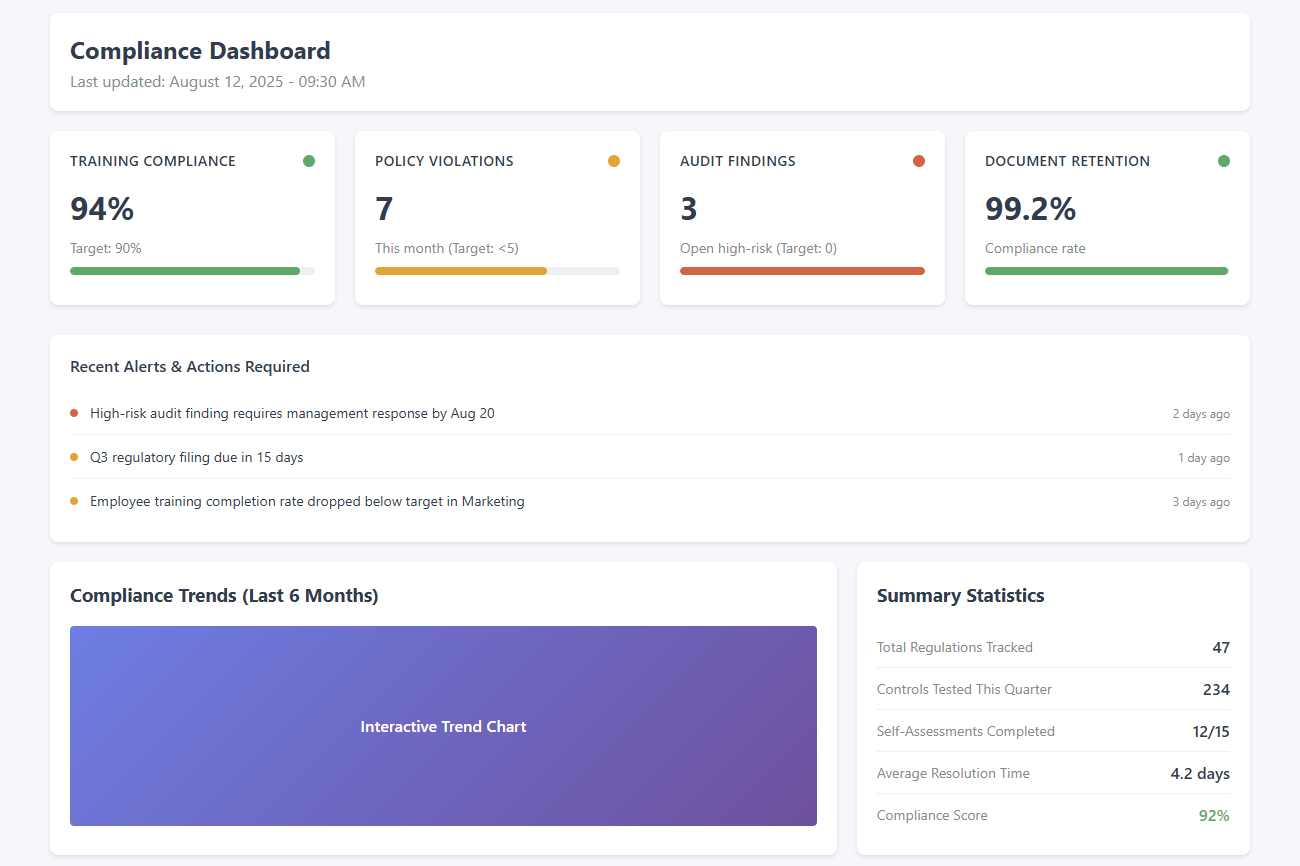

Compliance scorecards or dashboards

Dashboards transform complex compliance data into visual snapshots that executives and managers can quickly digest. They highlight problem areas and track improvement over time.

Effective dashboards use color-coded indicators (red/yellow/green) for quick status assessment and KPI-based metrics that tie to specific regulatory requirements.

Key compliance metrics and KPIs

Some companies get compliance measurement all backwards and measure what's easy instead of what matters. Smart organizations use KPIs as their crystal ball, spotting trouble before it hits and steering resources where they'll actually make a difference.

Good metrics reveal patterns that your gut instincts miss. Maybe violations always spike during quarter-end pushes, or certain departments consistently struggle with new regulations. These insights let you get ahead of problems instead of constantly reacting to them.

Common quantitative and qualitative metrics to track

Without proper metrics, your compliance team is basically playing whack-a-mole with problems. Try to track some of these common metrics:

- % of compliance controls operating effectively: Shows what percentage of your controls actually work when tested. Shoot for 95%+ effectiveness, but dig deeper when specific controls keep failing.

- Number of audit findings (high, medium, low): Tracks audit issues by severity. Don't just count them — watch the trends. Are high-risk findings climbing? Time to investigate why.

- Policy violation rates: Calculates violations per employee or transaction. Break it down by department, violation type, and time period to find your real problem spots.

- Training completion rates: Tracks who finishes required compliance training on schedule. Monitor completion percentages and how long people take after the assignment.

- Time to remediate issues: Measures how fast you fix compliance problems after discovery. Set different targets for high, medium, and low-risk issues.

- Number of regulatory updates tracked/implemented: Shows how well you keep up with changing rules. Track both finding new regulations and implementing the required changes.

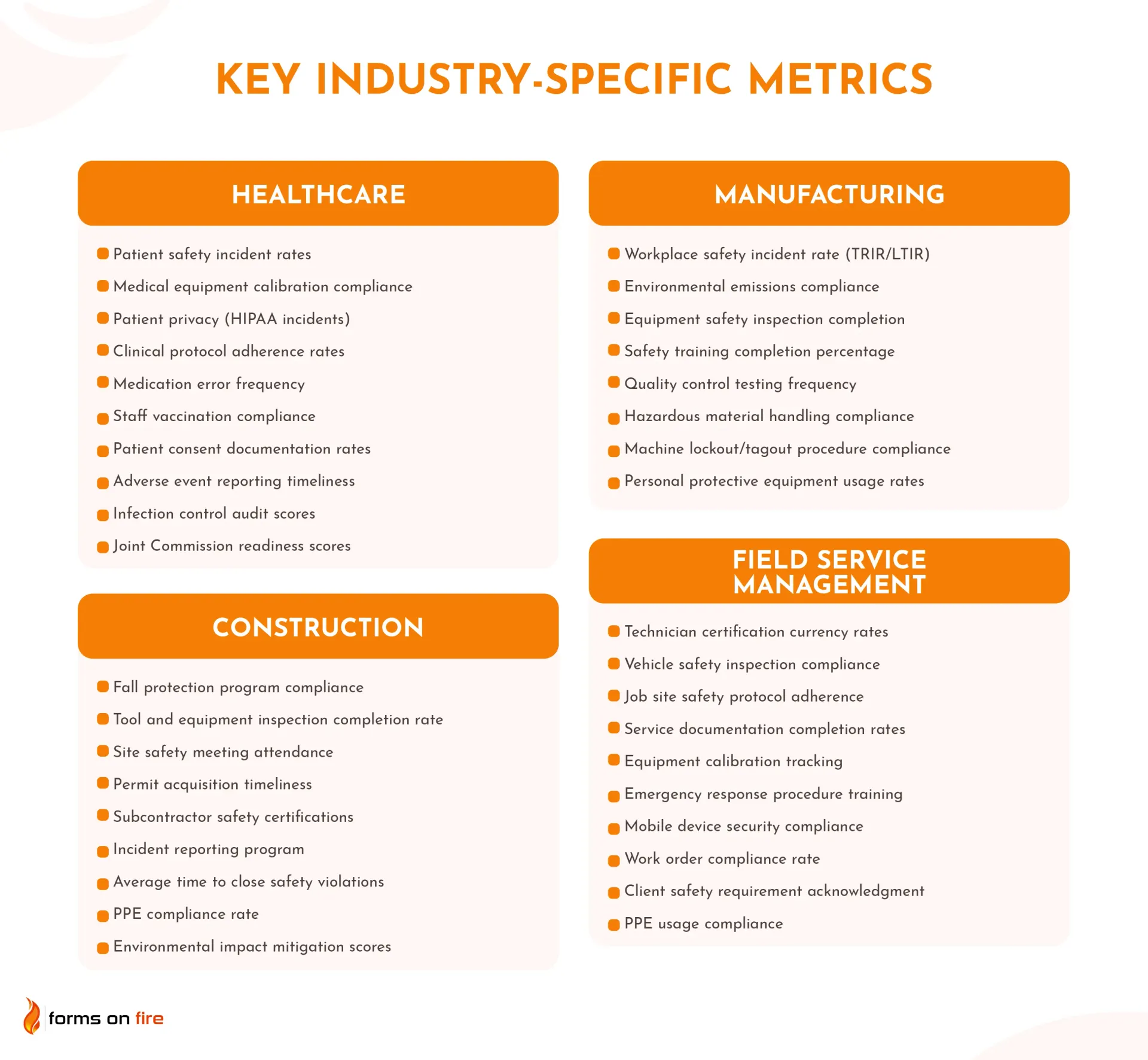

This list isn't exhaustive, and it shouldn't be. Your industry, risk profile, and regulatory landscape determine what you need to measure. Start with these fundamentals, then layer on industry-specific metrics that your regulators and stakeholders actually care about.

How to select the right metrics to track

Picking compliance management metrics can feel overwhelming when you're staring at dozens of potential KPIs. Don’t make the mistake of measuring everything you can instead of everything you should.

Here's how to cut through the noise and focus on metrics that matter:

- Start with your biggest risks: Your top compliance risks should drive measurement priorities. If data breaches could kill your business, track every metric related to access controls and incident response.

- Follow your regulators' playbook: Study examination manuals and recent enforcement actions in your industry. If agencies consistently cite training gaps, make training metrics a priority. They're showing you exactly what they'll scrutinize.

- Demand actionable insights: Every metric should drive specific actions. If "policy violation rates" can't be broken down by department and root cause, it's useless data. Ask: "If this metric shows a problem, what exactly would we do about it?".

- Test and ruthlessly edit: Run your initial metrics for a quarter, then evaluate what's actually driving better decisions. Drop measurements that look important but don't generate useful actions, even if executives think they should matter.

Your measurement system should evolve as your compliance program matures and risks shift. What matters most today won't necessarily be your priority next year.

Simplify compliance management with Forms On Fire

Measuring compliance is your defense against regulatory penalties, reputation damage, and business disruption.

Forms On Fire turns compliance tracking from spreadsheet hell into automated efficiency.

Teams complete checklists, submit incident reports, and streamline audits by following templates which are accessible on mobile devices. All data flows straight into centralized dashboards. No more hunting for paperwork or rebuilding reports from scratch.

Learn how companies use Forms On Fire to quantify their risk, run assessments, and comply with rules and laws for every authority.

FAQs about compliance measurement and monitoring

How do you measure regulatory compliance?

Use a combination of audits, control testing, and analytics to track specific metrics and actions that prove you follow required laws. Focus on measurements like audit findings, policy violations, and regulatory filing timeliness that directly tie to legal requirements.

How do you measure compliance performance?

Track KPIs that show how well your program prevents violations — control effectiveness percentages, remediation times, training completion rates, and incident response times. If you are using some type of software, automatic reports and dashboards with color-coded indicators can give a quick overview of your compliance performance.

How do you evaluate compliance?

Combine quantitative metrics with qualitative assessments through periodic audits, self-assessments, and continuous analytics. Compare performance against regulatory benchmarks and look at trends over time rather than point-in-time snapshots.

What measures do you take to comply with regulatory requirements?

Start with a compliance inventory of applicable laws, implement process controls that prevent violations, establish documentation for audit trails, and design monitoring systems that catch issues early. Lastly, match measurement frequency to risk levels.